CreditChek Blog

CreditChek is a cost effective, scalable credit assessment platform for B2B clients. Whether you’re a small lender or large enterprise, our solutions fit seamlessly into your operations.

Recent Posts

Joy Olawumi Oladokun

Feb 10, 2026

8 Min. Read

How to Reduce Loan Defaults in African Markets: A Data-Driven Guide for Lenders

Loan defaults in African markets average between 15% and 25%, nearly double the global benchmark of 8% to 12%. For lenders across Nigeria, Kenya, Ghana, and the broader continent, this gap represents billions in lost revenue and stunted growth.

Now, the question is not whether default rates can be reduced, but how. This guide examines why African lenders face higher defaults and provides three data-driven strategies to protect your portfolio and scale responsibly.

Why African Default Rates Are Higher Default rates in African lending consistently outpace global averages. Microfinance institutions across sub-Saharan Africa report average default rates between 18% and 22%. Digital lenders often see rates exceeding 20% in their first year of operation. These numbers reflect systemic challenges unique to African credit markets. Understanding these root causes is the first step toward prevention.

Problem 1: No Credit History Visibility Most African adults lack formal credit histories. Credit bureau penetration across sub-Saharan Africa remains below 15%, meaning the majority of loan applicants have no documented repayment behavior. When you cannot see a borrower’s credit history, you are lending blind. You have no way to know if they repay loans on time, carry multiple debts, or default regularly. The problem gets worse because credit infrastructure in Africa is fragmented. A borrower in Lagos might have loans with three different lenders, but if those lenders use different credit bureaus, that information stays hidden. One lender’s bad debt is another lender’s approved applicant.

Problem 2: Loan Stacking Loan stacking happens when borrowers take multiple loans from different lenders simultaneously, often with no intention of repaying any of them. Here is how it works: A borrower applies for a $500 loan with you on Monday. The application looks clean because you cannot see that the same borrower applied to three other lenders on the same day. By Friday, the borrower has $2,000 in debt across four institutions, far exceeding their ability to repay. Within weeks, all four lenders experience defaults. You see isolated bad debt. The borrower sees easy money. The systemic cost is billions in losses and declining trust in digital lending. Serial defaulters exploit this system intentionally. They understand that most lenders lack the infrastructure to detect repeat offenders across institutions. Until lenders adopt shared fraud prevention, loan stacking will continue driving default rates upward.

Problem 3: Inaccurate Income Assessment Income verification in African markets is complicated by high rates of informal employment. According to the International Labour Organization, over 85% of employment in sub-Saharan Africa is informal. Most borrowers lack pay slips, tax records, or stable income documentation. When lenders request bank statements, they face additional challenges. Manual analysis of bank statements is time-consuming and prone to error. Gig workers and small business owners show erratic cash flows that traditional methods struggle to assess. The result is either overly conservative decisions that reject good borrowers or lenient approvals that accept high-risk applicants who cannot afford repayment. Both outcomes hurt your business.

Problem 4: Weak Identity Verification

Identity fraud drives a significant portion of loan defaults in Africa. Borrowers using false identities, stolen credentials, or proxy applicants create defaults that are nearly impossible to recover because the actual borrower cannot be traced.

Many lenders accept photocopies of ID cards without verifying authenticity. Address verification is often skipped entirely. This creates opportunities for fraudsters to obtain loans under false pretenses with minimal consequences.

Without real-time identity verification, you are exposed to preventable fraud that directly impacts your default rate.

Three Strategies to Reduce Loan Defaults

Strategy 1: Verify Credit History Across All Bureaus The first step to reducing defaults is knowing who you are lending to. Comprehensive credit history verification shows you past repayment behavior, existing loan obligations, and patterns of default. The challenge is that different credit bureaus in African markets hold different subsets of borrower data. Checking only one bureau means missing critical information held by others.

The solution is integrating with all major credit bureaus simultaneously. Instead of logging into multiple platforms and waiting hours for reports, modern credit verification APIs let you query all bureaus through a single request. CreditChek’s Credit Insight provides access to all nationally accredited credit bureaus across African markets through one API call. Submit a customer ID and get their complete credit profile in 90 seconds instead of 20 minutes. You see repayment history, active loans, and default records from all available sources, giving you the complete picture before approval. Make credit checks mandatory for all loan applications above your minimum threshold. For high-value loans, multi-bureau checks should be standard practice.

Strategy 2: Stop Loan Stackers with Shared Fraud Prevention Loan stacking cannot be stopped by individual lenders acting alone. It requires collective action through shared fraud prevention networks. These networks work on a simple principle: when one lender reports a serial defaulter, all other lenders in the network are immediately alerted and can reject future applications from that borrower. This collective defense raises the cost of serial defaulting to unsustainable levels.

CreditChek’s Spectrum is a shared fraud prevention network that enables lenders to blacklist serial defaulters across participating institutions. When you report a chronic non-payer to Spectrum, they are flagged across 80+ financial institutions and automatically reported to credit bureaus. This creates immediate protection by denying future loans to flagged borrowers and long-term consequences through damaged credit scores that follow defaulters across institutions. Loan stackers thrive in fragmented markets. Shared networks eliminate the fragmentation and expose serial defaulters before they can damage your portfolio.

Strategy 3: Automate Income Verification and Affordability Assessment Manual income verification is slow, expensive, and inaccurate. Lenders processing hundreds of applications monthly cannot afford hours of manual bank statement analysis, nor can they tolerate the error rates that come with human review. Automated income verification tools analyze bank statements programmatically, identifying salary deposits, recurring income, expense patterns, and cash flow stability.

More importantly, automated tools assess affordability by calculating disposable income after fixed expenses and existing debt obligations. This ensures approved loan amounts align with borrower capacity to repay, reducing defaults caused by over-lending. CreditChek’s Income Insight analyzes transaction data from bank statements to verify income, detect cash flow irregularities, and determine appropriate loan sizes based on actual financial behavior. Upload a statement and get cash flow analysis, income verification, and affordability assessment in minutes instead of hours.

Income Insight also provides real-time identity verification that cross-references national ID databases, verifies biometric data where available, and confirms address accuracy. This stops identity fraud at the application stage, before loan disbursement.

Strengthen your KYC process with real-time verification. The cost of verification per application is negligible compared to the cost of a single fraudulent loan.

The ROI of Default Reduction Reducing default rates from 20% to 12% or less on a portfolio of $10 million in annual disbursements saves $800,000 in bad debt annually. Beyond direct savings, lower defaults improve key business metrics:

∙ Higher profitability per loan

∙ Increased investor confidence

∙ Faster portfolio scaling

∙ Improved customer lifetime value

Build Sustainable Lending Operations High default rates are not inevitable in African lending markets. They result from specific, addressable infrastructure gaps: insufficient credit data access, lack of fraud prevention coordination, and weak income verification. Lenders that invest in comprehensive verification infrastructure, participate in shared fraud networks, and implement automated underwriting see measurably lower default rates and better portfolio performance.

The tools exist. CreditChek provides API access to all major credit bureaus, automated income analysis, real-time identity verification, and collaborative fraud prevention networks, integrated into workflows that maintain fast customer experiences while improving risk assessment accuracy.

The choice is clear: continue operating with fragmented, manual verification and accept 20%+ default rates, or adopt modern credit infrastructure and operate at 10% to 12% or less default rates through better data and smarter underwriting. Default reduction is not just risk management. It is a competitive advantage that separates sustainable lenders from those destined for portfolio deterioration. Learn more about comprehensive credit verification solutions at www.creditchek.africa.

Tailored Articles

Looking for something specific? Select from the filters below!

category

tag

Joy Olawumi Oladokun

Feb 10, 2026

8 Min. Read

How to Reduce Loan Defaults in African Markets: A Data-Driven Guide for Lenders

Loan defaults in African markets average between 15% and 25%, nearly double the global benchmark of 8% to 12%. For lenders across Nigeria, Kenya, Ghana, and the broader continent, this gap represents billions in lost revenue and stunted growth.

Now, the question is not whether default rates can be reduced, but how. This guide examines why African lenders face higher defaults and provides three data-driven strategies to protect your portfolio and scale responsibly.

Why African Default Rates Are Higher Default rates in African lending consistently outpace global averages. Microfinance institutions across sub-Saharan Africa report average default rates between 18% and 22%. Digital lenders often see rates exceeding 20% in their first year of operation. These numbers reflect systemic challenges unique to African credit markets. Understanding these root causes is the first step toward prevention.

Problem 1: No Credit History Visibility Most African adults lack formal credit histories. Credit bureau penetration across sub-Saharan Africa remains below 15%, meaning the majority of loan applicants have no documented repayment behavior. When you cannot see a borrower’s credit history, you are lending blind. You have no way to know if they repay loans on time, carry multiple debts, or default regularly. The problem gets worse because credit infrastructure in Africa is fragmented. A borrower in Lagos might have loans with three different lenders, but if those lenders use different credit bureaus, that information stays hidden. One lender’s bad debt is another lender’s approved applicant.

Problem 2: Loan Stacking Loan stacking happens when borrowers take multiple loans from different lenders simultaneously, often with no intention of repaying any of them. Here is how it works: A borrower applies for a $500 loan with you on Monday. The application looks clean because you cannot see that the same borrower applied to three other lenders on the same day. By Friday, the borrower has $2,000 in debt across four institutions, far exceeding their ability to repay. Within weeks, all four lenders experience defaults. You see isolated bad debt. The borrower sees easy money. The systemic cost is billions in losses and declining trust in digital lending. Serial defaulters exploit this system intentionally. They understand that most lenders lack the infrastructure to detect repeat offenders across institutions. Until lenders adopt shared fraud prevention, loan stacking will continue driving default rates upward.

Problem 3: Inaccurate Income Assessment Income verification in African markets is complicated by high rates of informal employment. According to the International Labour Organization, over 85% of employment in sub-Saharan Africa is informal. Most borrowers lack pay slips, tax records, or stable income documentation. When lenders request bank statements, they face additional challenges. Manual analysis of bank statements is time-consuming and prone to error. Gig workers and small business owners show erratic cash flows that traditional methods struggle to assess. The result is either overly conservative decisions that reject good borrowers or lenient approvals that accept high-risk applicants who cannot afford repayment. Both outcomes hurt your business.

Problem 4: Weak Identity Verification

Identity fraud drives a significant portion of loan defaults in Africa. Borrowers using false identities, stolen credentials, or proxy applicants create defaults that are nearly impossible to recover because the actual borrower cannot be traced.

Many lenders accept photocopies of ID cards without verifying authenticity. Address verification is often skipped entirely. This creates opportunities for fraudsters to obtain loans under false pretenses with minimal consequences.

Without real-time identity verification, you are exposed to preventable fraud that directly impacts your default rate.

Three Strategies to Reduce Loan Defaults

Strategy 1: Verify Credit History Across All Bureaus The first step to reducing defaults is knowing who you are lending to. Comprehensive credit history verification shows you past repayment behavior, existing loan obligations, and patterns of default. The challenge is that different credit bureaus in African markets hold different subsets of borrower data. Checking only one bureau means missing critical information held by others.

The solution is integrating with all major credit bureaus simultaneously. Instead of logging into multiple platforms and waiting hours for reports, modern credit verification APIs let you query all bureaus through a single request. CreditChek’s Credit Insight provides access to all nationally accredited credit bureaus across African markets through one API call. Submit a customer ID and get their complete credit profile in 90 seconds instead of 20 minutes. You see repayment history, active loans, and default records from all available sources, giving you the complete picture before approval. Make credit checks mandatory for all loan applications above your minimum threshold. For high-value loans, multi-bureau checks should be standard practice.

Strategy 2: Stop Loan Stackers with Shared Fraud Prevention Loan stacking cannot be stopped by individual lenders acting alone. It requires collective action through shared fraud prevention networks. These networks work on a simple principle: when one lender reports a serial defaulter, all other lenders in the network are immediately alerted and can reject future applications from that borrower. This collective defense raises the cost of serial defaulting to unsustainable levels.

CreditChek’s Spectrum is a shared fraud prevention network that enables lenders to blacklist serial defaulters across participating institutions. When you report a chronic non-payer to Spectrum, they are flagged across 80+ financial institutions and automatically reported to credit bureaus. This creates immediate protection by denying future loans to flagged borrowers and long-term consequences through damaged credit scores that follow defaulters across institutions. Loan stackers thrive in fragmented markets. Shared networks eliminate the fragmentation and expose serial defaulters before they can damage your portfolio.

Strategy 3: Automate Income Verification and Affordability Assessment Manual income verification is slow, expensive, and inaccurate. Lenders processing hundreds of applications monthly cannot afford hours of manual bank statement analysis, nor can they tolerate the error rates that come with human review. Automated income verification tools analyze bank statements programmatically, identifying salary deposits, recurring income, expense patterns, and cash flow stability.

More importantly, automated tools assess affordability by calculating disposable income after fixed expenses and existing debt obligations. This ensures approved loan amounts align with borrower capacity to repay, reducing defaults caused by over-lending. CreditChek’s Income Insight analyzes transaction data from bank statements to verify income, detect cash flow irregularities, and determine appropriate loan sizes based on actual financial behavior. Upload a statement and get cash flow analysis, income verification, and affordability assessment in minutes instead of hours.

Income Insight also provides real-time identity verification that cross-references national ID databases, verifies biometric data where available, and confirms address accuracy. This stops identity fraud at the application stage, before loan disbursement.

Strengthen your KYC process with real-time verification. The cost of verification per application is negligible compared to the cost of a single fraudulent loan.

The ROI of Default Reduction Reducing default rates from 20% to 12% or less on a portfolio of $10 million in annual disbursements saves $800,000 in bad debt annually. Beyond direct savings, lower defaults improve key business metrics:

∙ Higher profitability per loan

∙ Increased investor confidence

∙ Faster portfolio scaling

∙ Improved customer lifetime value

Build Sustainable Lending Operations High default rates are not inevitable in African lending markets. They result from specific, addressable infrastructure gaps: insufficient credit data access, lack of fraud prevention coordination, and weak income verification. Lenders that invest in comprehensive verification infrastructure, participate in shared fraud networks, and implement automated underwriting see measurably lower default rates and better portfolio performance.

The tools exist. CreditChek provides API access to all major credit bureaus, automated income analysis, real-time identity verification, and collaborative fraud prevention networks, integrated into workflows that maintain fast customer experiences while improving risk assessment accuracy.

The choice is clear: continue operating with fragmented, manual verification and accept 20%+ default rates, or adopt modern credit infrastructure and operate at 10% to 12% or less default rates through better data and smarter underwriting. Default reduction is not just risk management. It is a competitive advantage that separates sustainable lenders from those destined for portfolio deterioration. Learn more about comprehensive credit verification solutions at www.creditchek.africa.

Jane Ezetah

Oct 15, 2025

2 Min. Read

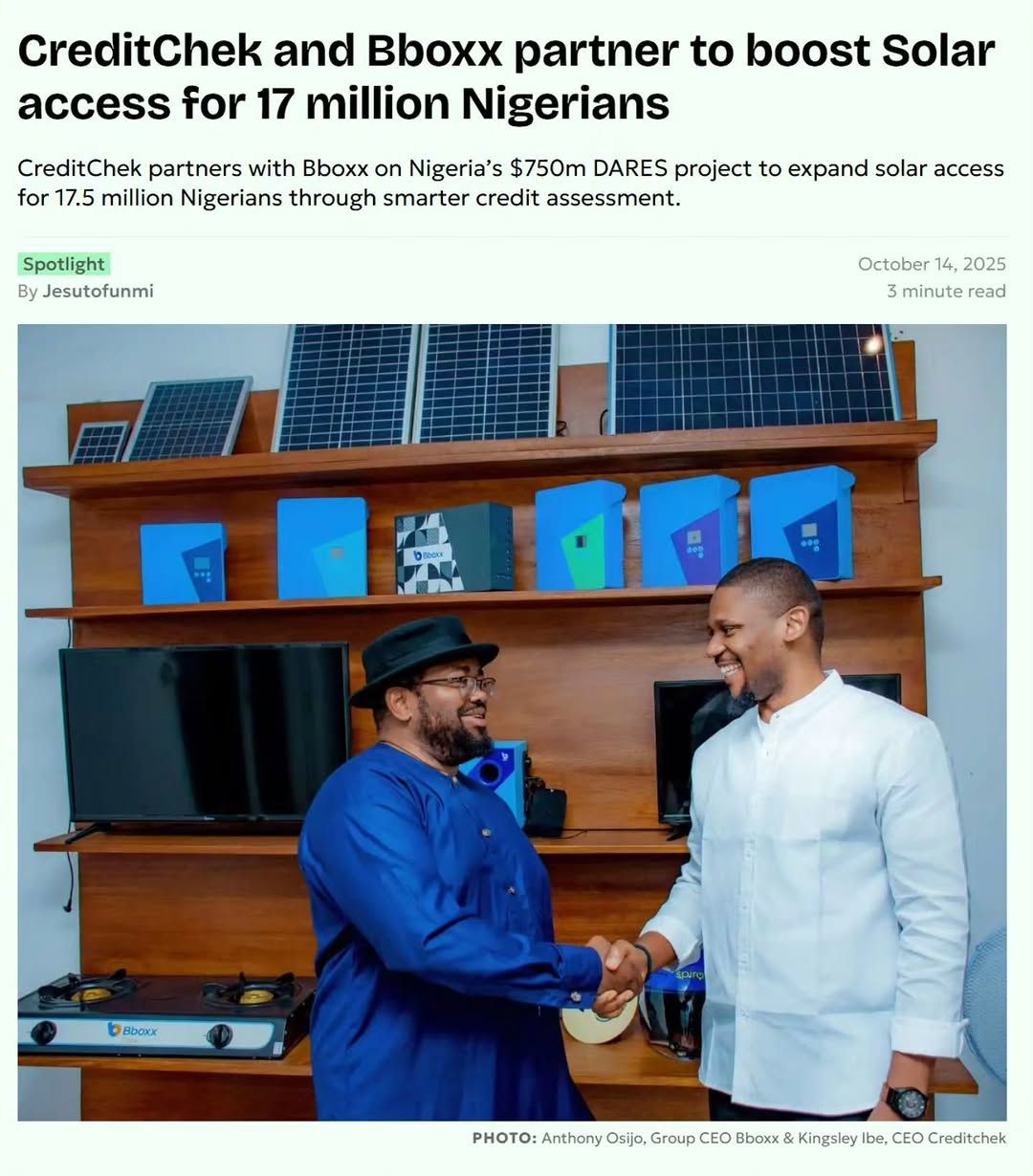

CreditChek and Bbox partner to boost Solar access for 17 million Nigerians

At CreditChek, our mission has always been clear, to make financial inclusion borderless, accessible, and data-driven.

Today, we’re taking another step toward that vision.

We are proud to announce our partnership with Bboxx Nigeria, a leading provider of solar energy solutions, to expand access to clean energy for over 17.5 million Nigerians under the World Bank–backed DARES renewable energy initiative.

.jpg)

This collaboration combines Bboxx’s expertise in solar distribution and financing with CreditChek’s AI-powered credit assessment infrastructure, enabling more equitable access to solar financing.

Together, we are streamlining underwriting, improving repayment predictability, and empowering off-grid households with affordable, sustainable energy.

WHY IT MATTERS

Millions of Nigerians still live off-grid or face irregular power supply, limiting their ability to work, learn, and build wealth. Access to solar energy changes that, but financing often remains a barrier.

By connecting data-driven credit assessment to solar distribution, we are breaking that barrier and creating new pathways to energy, opportunity, and inclusion.

For us, this partnership reinforces a simple truth — access to energy and access to finance are deeply connected.

When we build smarter credit systems, we unlock more than power; we unlock possibilities for millions.

Together, we’re lighting up homes, powering opportunities, and shaping a brighter financial future.

CreditChek — your credit, without borders.

For partnership or product inquiries, visit www.creditchek.africa

Subscribe to get Update On Every New Blog

Join over 4,000+ already connected with CreditChek.

.jpg)

.jpg)

.jpg)

.jpg)

-300x400.jpg)